AI-Driven Impact Pricing:

Estimating the effects of environmental factors on corporate valuations

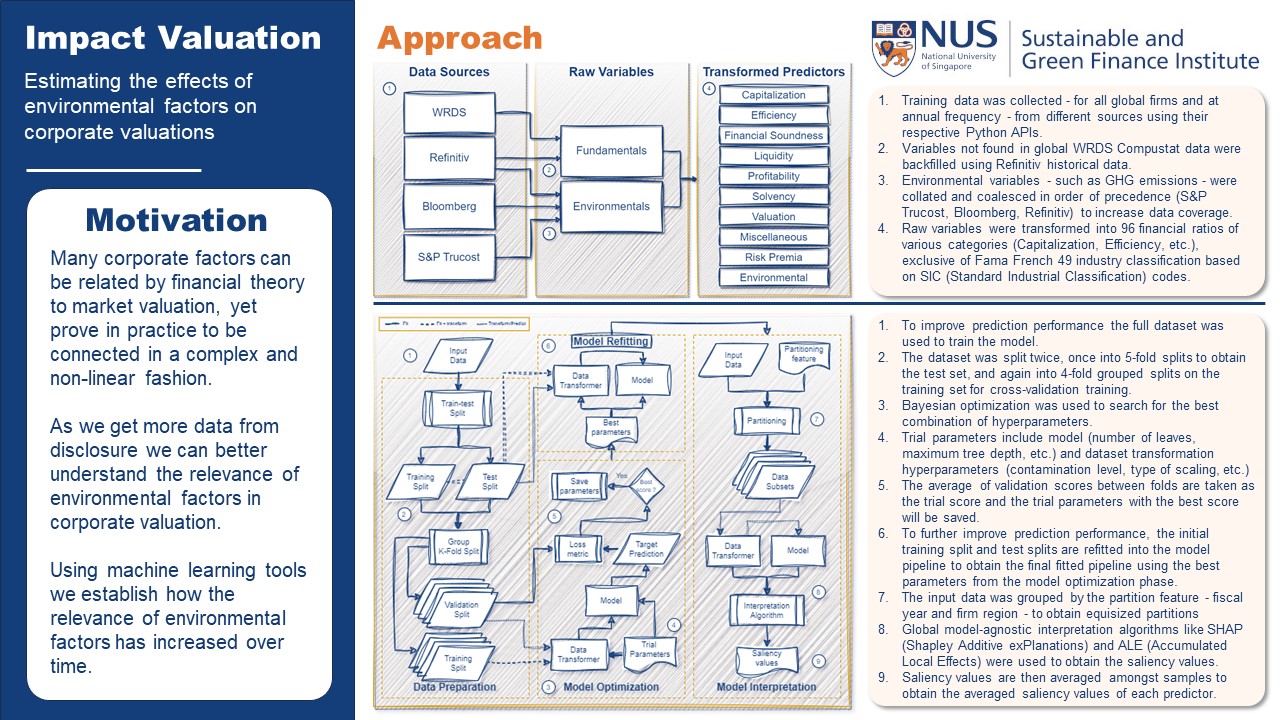

Accurately predicting corporate financial value, and the relative importance of factors which determine it, is a key if not the most central objective of financial analysis. In this project we place attention towards developing credible models linking corporate financial factors with stock market valuation using leading-edge machine learning (ML) techniques.

ML methods offer several advantages over conventional analytical tools typically used by financial analysts. Many corporate factors (fundamentals) can be related to market valuation motivated by financial theory yet prove in practice to be connected in a nuanced, complex, and non-linear fashion. For this reason, with the objective of accurately linking corporate (environmental and social) impact measures to stock market valuations, and in turn quantifying the monetary values of environmental factors for all (publicly listed) firms around the world, we cannot rely on simple linear regressions.

To better understand the changing relevance of environmental factors in corporate valuation we develop an impact valuation framework utilizing gradient boosting machines—a decision tree based machine learning framework—which provides accurate and robust predictions without over-fitting data. Such tools are particularly helpful when the underlying relationships between the factors and the predicted financial outcomes are complex or not uniquely defined by theory.