In a compelling episode of the AIB Podcast, Professor Johan Sulaeman, Director of SGFIN, shared how green finance is reshaping the future of capital allocation. Moving beyond traditional profit-driven models, green finance is emerging as a strategic lever to drive long-term environmental and social value. Prof Johan highlighted the urgent need for clearer impact metrics, inclusive transition frameworks, and cross-sector collaboration to unlock scalable climate solutions. This timely conversation offers deep insights into innovation, climate finance, and the path to COP30, reinforcing SGFIN’s commitment to advancing financial practices that deliver lasting value for investors, society, and the planet.

With the closure of the Net-Zero Banking Alliance, Prof Johan Sulaeman, Director of SGFIN, highlighted a pivotal moment for Asian banks and regulators. He emphasized that transparency, consistent climate disclosures, and stronger accountability are essential to maintain credible net-zero commitments. While the absence of a global oversight body creates challenges, it also presents a rare opportunity: banks can take direct ownership of their decarbonisation journeys, aligning strategies with regional and sectoral realities. Prof Johan called on regulators and industry groups to provide guidance and frameworks that ensure progress remains measurable, transparent, and impactful.

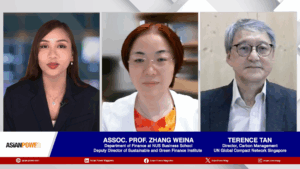

For too long, the environmental cost of major events have been discounted – invisible behind ticket sales and headline attendance. In the Straits Times, Associate Professor Zhang Weina and Yannis Yuan propose that Singapore’s Meetings, Incentives, Conferences, and Exhibitions (MICE) industry must measure and disclose its true carbon footprint to stay competitive on the global stage. SGFIN’s new MICE carbon calculator turns unseen impacts into actionable data, helping organisers pinpoint real emission drivers and make meaningful reductions. By linking accountability to industry incentives and standards, Singapore can lead the world not only in hosting world-class events, but in ensuring they align with climate responsibility.

The Straits Times article | SGFIN MICE Carbon Calculator | SGFIN Whitepaper | LinkedIn Post

Finance sits at the centre of climate resilience – a key insight from Professor Johan Sulaeman, Director of SGFIN, in his keynote address at the International Corporate Governance Conference 2025. Drawing on SGFIN’s research, he illustrated how financial systems connect three critical domains: local adaptation, carbon markets, and global capital markets. By expanding farmer financing, enhancing carbon market transparency, and embedding sustainability into investment decisions, SGFIN is shaping how capital can be mobilised to drive measurable climate resilience across ASEAN and beyond.

In a Business Times commentary, SGFIN’s Deputy Director Assoc Prof Zhang Weina, together with Michael Alexander, Fanny Xueqi Or, Jiaxin Zhang, and Feimo Zhang, discussed the challenges and opportunities of developing a sustainable biofuel industry. Using Singapore’s new sustainable aviation fuel levy as context, the article highlights that while the levy is an important first step in decarbonising aviation, SGFIN also calls for strengthening biofuel producers’ resilience through circular business models, fostering innovation, introducing supply-side incentives, and advancing regional collaboration across ASEAN.

Business Times article | BizBeat NUS article | SGFIN Whitepaper | SGFIN LinkedIn post

Sustainable finance must move past generic “green” claims to deliver tangible environmental outcomes. In The Business Times and CETEX publication, Professor Johan Sulaeman, Director of SGFIN, highlights the need for green loans to be backed by measurable biodiversity metrics. Ecological costs — such as land clearing and vegetation loss — should be transparently assessed to ensure credibility. By integrating biodiversity safeguards, ecological data, and long-term environmental performance into sustainability-linked loans, financiers can strengthen market integrity and align with public expectations. This shift positions sustainable finance as a powerful tool for real ecological progress, not just symbolic gestures.

Business Times article | CETEX publication | SGFIN LinkedIn post

Associate Professor Zhang Weina (Department of Finance) commented on the 4th Singapore Business Carbon Report, which found that 74% of businesses — mainly SMEs — cut their emissions through the LowCarbonSG programme. Prof Zhang noted that sharper insights are helping companies act more effectively, and that digital technology has empowered the companies, some even leveraging the data collected to uncover inefficiencies, thereby supporting their investment in opportunities that lead to cost savings and product innovations.

As Singapore contends with the prospect of Semakau Landfill reaching capacity, the imperative to re-examine waste management, recycling, and circular economy strategies has never been clearer. Speaking on CNA938 Rewind, Professor Johan Sulaeman, Director of SGFIN, highlighted that continued reliance on landfills is unsustainable. Progress lies in upstream interventions – from minimising waste generation and embedding design for reuse, to advancing recycling technologies and strengthening incentives for circular business models. With coordinated action across policy, regulatory frameworks, and consumer behaviour, Singapore has the opportunity to transform this pressing challenge into a model of waste resilience and sustainable innovation for cities worldwide.

SGFIN Director Professor Johan Sulaeman and Research Fellow Dr David Broadstock, together with two co-authors, contributed to this working paper, exploring the untapped potential of sustainability-linked finance (SLF) to address nature-related risks in Southeast Asia. As the region’s rich biodiversity faces increasing threats from deforestation, water stress, and land-use change, the paper presents the first comprehensive analysis of Southeast Asia’s SLF market and addresses critical gaps in integrating nature-related risks into financial instruments.

Using market analysis and a retrieval-augmented generation approach to classify key performance indicators (KPIs), the authors reveal that 60% of nature-related KPIs disclosed in corporate reports —particularly those related to water usage and waste management — are absent from SPTs in SLF deals, presenting significant opportunities for improved ecological accountability. The authors’ findings underscore the need for harmonising regional frameworks (e.g. ASEAN SLB Standards) with global guidelines like the Taskforce on Nature-related Financial Disclosures (TNFD) to standardise SPTs, improve transparency and mitigate greenwashing risks. Four policy implications for enhancing the transparency, credibility and scalability of SLF instruments in Southeast Asia are identified.

In this article for East Asia Forum, Professor Johan Sulaeman (Director), Associate Professor Zhang Weina (Deputy Director) and Kim Seonghoon (Research Fellow) examine the Singapore–Asia Taxonomy for Sustainable Finance (SAT). The SAT has set rigorous standards for green and transition financing, establishing important benchmarks for ASEAN countries interoperable with the EU Taxonomy. To further its effectiveness and global relevance, the SAT should encourage more widespread adoption, raise public awareness of sustainable finance, maintain alignment with evolving global energy transition standards and conduct periodic assessments of its integration into decision-making processes.