Singapore gives nod to import two gigawatts of low-carbon electricity from Indonesia

Dr David Broadstock, SGFIN Senior Research Fellow and Energy Transition lead, was interviewed live on CNA’s Singapore Tonight, discussing the latest developments in achieving Singapore’s energy transition. The interview considers the importance of the move by the Energy Market Authority (EMA) to provide conditional approval for two gigawatts of new clean electricity imports into Singapore.

Channel News Asia videoSingapore studying the need to further expand its LNG infrastructure

Dr David Broadstock, SGFIN Senior Research Fellow and Energy Transition lead, appeared on CNA news commenting on the exploration of standards for carbon-accounted LNG trade in Singapore following the announcement made by H.E. Dr Tan See Leng, Minister for Manpower and Second Minister for Trade and Industry of Singapore.

The clamour for elusive climate grants

Dr David Broadstock, SGFIN Senior Research Fellow and Energy Transition lead, contributes his thoughts into the use of grant financing to support energy transition investments for this article appearing on Eco-Business. The article is a part of the Eco-Business series on “Decoding Sustainable Finance …”

Breaks and reforms/reformulates

Assoc Prof Zhang Weina, Deputy Director of SGFIN, shared her perspectives about various topics such as the pricing of carbon credits in Asian markets, the complexities of green bonds and the failure of SVB in this commentary.

How I got here… National University of Singapore green finance academic Sumit Agarwal

Prof Sumit Agarwal, Managing Director of SGFIN, delves into his transition from the corporate world to academia and how his initial passion for sustainability was reignited at NUS. He also comments on the criticism surrounding green finance and discusses how SGFIN aims to address these concerns and build expertise in the field.

How will India’s green credit scheme work?

Prof Sumit Agarwal, Managing Director of SGFIN saw the importance of incentive-based scheme to drive positive environmental outcomes and become environmentally viable.

Huawei’s Tech4City Competition to tap on youth tech talents to drive smart mobility and sustainability financing

Assoc Prof Zhang Weina, Deputy Director of SGFIN, shared how technological advancements in renewable energy solutions have ushered in new considerations in business financing models. She also highlighted proposed solutions by NUS students in the SGFIN-Fidelity Sustainable Finance Case Competition 2023 to facilitate the small and medium enterprises (SMEs) to transition into more sustainable business practices.

Can the Asean Taxonomy Help Achieve the Region’s Sustainability Ambitions?

Prof Sumit Agarwal, Managing Director of SGFIN reckoned that the biggest benefit of a regional taxonomy is that it provides a common language for companies and investors to communicate sustainability performance. Assoc Prof Zhang Weina, Deputy Director of SGFIN added that the benefits of unification [of country-level taxonomies to create a regional framework] are numerous, such as reducing the compliance cost across different countries, faster speed of adoption and greater transparency.

Era of the Super App

(National Geographic Asia) Professor Sumit Agarwal, professor of Finance, raised the concern of discrimination in traditional labour markets and shared how the use of Super App can eliminate discrimination by focusing solely on product delivery. (Watch the sharing from 15:50 to 16:09)

Helping developing countries while driving sustainability: How World Bank balances the two

Ms Anshula Kant, Managing Director and Chief Financial Officer, World Bank Group, shared how capital markets can drive sustainable development goals in a talk jointly organised by NUS Business School and SGFIN.

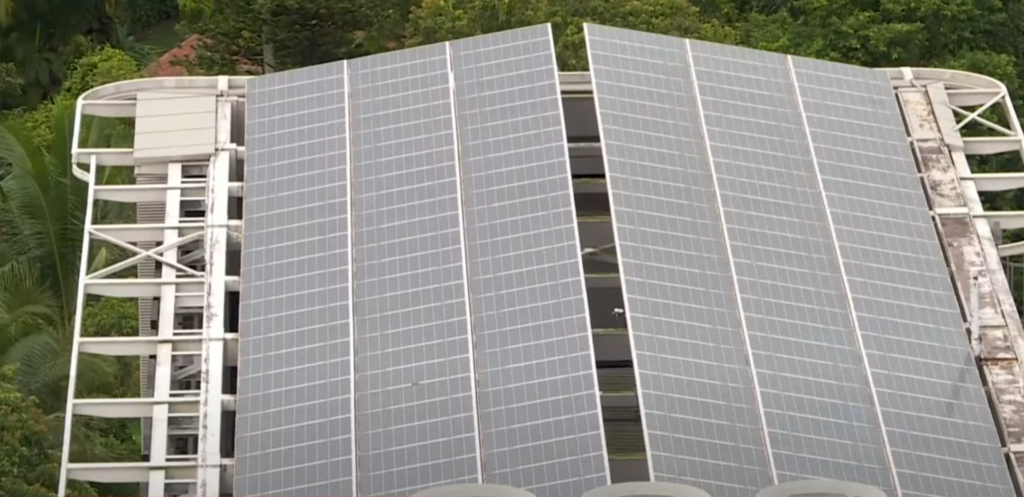

Charting a Green Transition for Small-and-Medium Enterprises

The university-wide SGFIN-Fidelity Sustainable Finance Case Competition 2023 was a meaningful journey for more than 150 participating students. Assoc Prof Zhang Weina, Deputy Director of SGFIN, and Ms Vigilia Ang, Research Associate at SGFIN, summarised the key takeaways of the top three winning teams’ financially viable solutions and presented alternative solutions proposed by the other finalist teams for SMEs’ solar energy adoption towards sustainability.

Carbon credits: catalyzing green finance

Assoc Prof Johan Sulaeman, Director of SGFIN, and Assoc Prof Zhang Weina, Deputy Director of SGFIN, discussed the current and future scenario of carbon credits in Southeast Asia and shared SGFIN’s research initiatives with regard to carbon credits. Insights on voluntary carbon credits and views on the pricing of carbon credits were also explored.