On 20 April, Deputy Prime Minister and Minister for Finance Lawrence Wong officially launched SGFIN. In his address, he emphasized the significance of robust research to support the advancement of green and transition finance, as well as to aid businesses in crafting innovative green solutions. DPM Wong also used the official launch as a platform to announce the “Finance for Net Zero Action Plan (FiNZ Action Plan)”. NUS President Professor Tan Eng Chye expressed that SGFIN will play a crucial role in building strong capabilities in green finance, contributing to the reinforcement of Singapore's position as a global financial hub.

From the official opening of SGFIN to developments in its four core focus area, 2023 proved to be an exhilarating year for the NUS Sustainable and Green Finance Institute (SGFIN). Let’s reflect on the past year and anticipate new developments in 2024 as we look forward to the institute’s continued progress.

Research Initiatives

In the realm of sustainable finance, SGFIN made notable contributions to journal publications in the year 2023.

-

- Are environmental punishments good news or bad news? Evidence from China. Journal of Environmental Economics and Management

- Long-term effects of air pollution on Singapore’s national university admissions. Applied Economics Letters

- Expanding footprints: The impact of passenger transportation on corporate locations. Review of Finance

In addition, SGFIN also contributed to Asian Impact Management Review (AIMR) winter 2023 issue. The article titled “Creating a Common Language for Impact Assessment” review different methods of harmonizing the impact metrics by monetization to provide a standardized assessment of sustainable investments.

SGFIN’s whitepaper series was launched in November 2023. It aims to provide information to readers about a specific topic related to sustainable finance. They provide a deep dive into the subject matter, offering new insights. The first whitepaper titled “Impact Valuation of Energy Transition Projects in Asia: 2013-2022” was released on 9th November. The significance of this whitepaper lies in providing future project developers with easier access to a consistent valuation framework, enabling financial institutions and corporates to finance and invest in similar energy transition projects more efficiently.

SGFIN’s 2nd whitepaper titled “ESG Data Primer: Current Usage & Future Applications” was made available on 22nd December. The whitepaper unravels the complexities associated with mainstream use of ESG data, uncovering inconsistencies within and between providers as well as discrepancies with companies’ self-reported sustainability data.

In 2024, look forward to an upcoming series of whitepapers, expanding across diverse subjects, addressing topics such as the carbon footprint of MICE (Meetings, Incentives, Conferences, and Exhibitions) and the impact valuation of buildings.

SGFIN's Research Conference on Sustainability stands as a cornerstone of intellectual exchange and innovation within the realm of green finance. In 2023, the conference was held on 21 April and was divided into four sessions – Climate Policy, Sustainable Supply Chain, Green Instruments, and Portfolio Choice. The Fidelity Best Paper Award is presented to Professor Tony Berrada, University of Geneva, for the paper titled “The Economics of Sustainability-Linked Bonds”. This annual event serves as a dynamic platform for researchers, academics, and industry experts to converge, sharing cutting-edge insights, methodologies, and findings in the pursuit of sustainable financial practices.

Looking ahead, we are organizing a Sustainability Summit and Research Conference on 21 and 22 March 2024 around the grand theme of “Costs and Opportunities of Commitment to Net-Zero”.

SGFIN co-organized dedicated sessions on Sustainable and Green Finance for the 10th Annual Conference of ABFER. During these sessions, six research studies were presented by researchers from leading institutions around the world. This collaborative effort aimed to facilitate discussions and share research insights, contributing to the broader discourse on sustainable financial practices within the global academic community.

SGFIN organized the Sustainability Research Insights Series is to celebrate our (NUS) scholars and their impact. Open to the public, this series aim to (i) embrace the multi-disciplinary nature of NUS , (ii) better equip ourselves for the ‘wicked problem’ of climate change and (iii) provide a focal point on critical research meta-narratives.

During the initial session, we were privileged to host Dr. Dariusz Wójcik, Professor of Financial Geography at NUS and Honorary Research Associate at the School of Geography and the Environment, University of Oxford. The focal point of the discussion was "The evolving landscape of the financial world and its significance."

Education

In 2023, SGFIN has made significant strides in fulfilling its mission to train and provide talent and leadership in sustainable and green finance practices, achieving notable milestones along the way.

In August, the first batch of MSc Sustainable and Green Finance (MSc SGF) officially graduated, marking a significant milestone in SGFIN’s ongoing commitment to cultivating a new generation of professionals well-versed in sustainable finance practices. The second batch of the MSc programme, with a larger cohort, underscores the growing significance of education in fostering expertise and awareness in sustainable and green finance practices.

In 2024, we are excited to announce the introduction of the Part-time MSc SGF program.

In our continuous effort to enhance the learning experience for our MSc students, SGFIN organizes a weekly industry series. This initiative involves inviting accomplished professionals from various industries, including banking, consulting, and fintech, who are at the forefront of sustainability leadership. These industry experts share their valuable insights and experiences with our students through engaging talks, contributing to a well-rounded understanding of the field.

We express our gratitude to the individuals listed below for generously sharing their insights in the year 2023.

-

- Ms Herry Cho, Managing Director, Head of Sustainability and Sustainable Finance, SGX

- Ms Priyaka N Dhingra, Director, Climate Change and Sustainability Services, Financial Institutions Lead, Ernst & Young

- Mr Alakesh Dutta, NUS Department of Architecture

- Mr Sean Jutahkit, Senior Vice President, Head of Asian Credit Research, Neuberger Berman

- Ms Rehmat Johal, Vice President, Sustainable & Transition Solutions, BlackRock

- Ms Koh Lin-Net, Director, Centre for Impact Investing and Practices

- Mr Helge Muenkel, Chief Sustainability Officer, DBS

- Dr Falko Paetzold, Initiator and Managing Director, Center for Sustainable Finance and Private Wealth

- Ms Rohini Samtani, Business Development Manager, Climate Risk, S&P Global

- Mr Suresh Sivanandam, Sales Director, Energy Transition, S&P Global

- Mr Benjamin Soh, Managing Director, STACS

- Ms Tan Bee Lay, Chief Sustainability Officer, SDAX

- Mr Benjamin Towell, Executive Director, OCBC

SGFIN also organized a Research Seminar Series, providing the NUS community with the opportunity to stay up-to-date with the latest developments in sustainable finance research. The research encompasses a broad range of topics, spanning from biodiversity to electric vehicles.

We would like to take this opportunity to express our sincere gratitude to all fellow academics for their invaluable contributions and support in sharing their knowledge and insights.

-

- Dr Roman Carrasco, Associate Professor, Department of Biological Sciences

- Dr Foo Maw Lin, Senior Lecturer, Department of Chemistry

- Dr Su Bin, Senior Research Fellow, Head of Energy and the Environment Division, Energy Studies Institute

- Dr Tan Soo Jie-Sheng, Assistant Professor, Lee Kuan Yew School of Public Policy

- Dr Thomas Vinod, Visiting Professor, Lee Kuan Yew School of Public Policy

- Dr Zheng Huanhuan, Assistant Professor, Lee Kuan Yew School of Public Policy

In the first quarter of 2023, SGFIN organized the inaugural SGFIN-Fidelity Case Competition, providing students with the opportunity to apply academic knowledge to address real-world sustainability challenges. The theme of the case study is “Solar Panels financing for SMEs”. With 40 groups from NUS participating, the finals featured a judging panel consisting of five industry leaders, evaluating the innovative solutions presented by the eight teams advancing to the final round.

We sincerely thank the judges for their time and expertise.

- Mr Ashwin Balasubramanian, Partner, McKinsey & Company

- Mr Sylvain Richer de Forges, Director, Sustainability, Bank of Singapore

- Ms Lin-Net Koh, Director, Centre for Impact Investing and Practices (CIIP)

- Mr Sharad Somani, Partner, Head of Infrastructure, Asia Pacific, KPMG

- Mr Boon Siong Wee, CEO, RHT Green

The final for this year’s case competition will be held on 30 April 2024. Click here for more information.

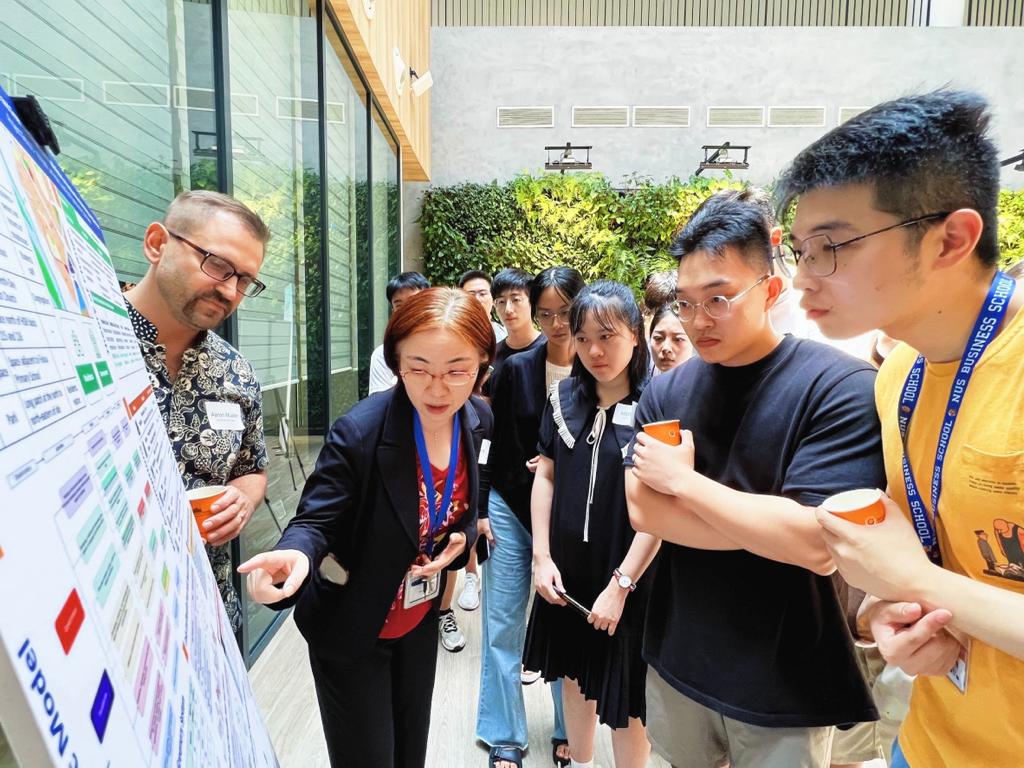

On August 11, SGFIN hosted the Gallery Walk, a platform for our graduating students from the MSc in Sustainable and Green Finance to showcase their Capstone projects. These projects, developed in collaboration with our esteemed industry partners, offer a valuable opportunity for students to apply the concepts and methodologies acquired throughout the program.

We again extend our appreciation to our industry partners such as Bank of Singapore, Clifford Capital, GIC, KPMG, RHT Green, SMBC, UOB, and WWF for their insightful guidance and nurturing for our students.

Actively engaged in advancing continuing education, SGFIN is curating training courses tailored for working professionals. In 2023, SGFIN rolled out 3 courses.

-

- Green Financing for the Built Environment

- Enterprise Carbon Accounting

- Social and Sustainable Investing

These courses have garnered participants from a broad spectrum of backgrounds and have consistently received positive reviews. SGFIN looks forward to maintaining its commitment to delivering high-quality executive courses.

A more extensive array of executive education programs will be launched in 2024. To find out more, click here.

Industry Engagement

SGFIN has been actively involved in numerous initiatives and collaborations with industry partners at the forefront of sustainability. This engagement underscores our commitment to driving innovation and fostering sustainable practices.

On 28 April, SGFIN had the privilege of hosting Ms. Anshula Kant, Managing Director and Chief Financial Officer (CFO) of the World Bank Group, to discuss the crucial topic of “Connecting Investors to a More Sustainable Future”. She shared insights into the World Bank Group's mission, emphasizing its commitment to reducing poverty and inequality. This mission has become even more critical in light of recent global shocks, including the challenges posed by the COVID-19 pandemic and the ongoing war in Ukraine. By addressing the impact of climate change-related disasters, particularly on vulnerable populations, the World Bank aims to contribute to a more equitable and resilient global community.

On 1 November, SGFIN had the distinct honour of hosting Prof. Bambang Brodjonegoro, the Former Minister of Indonesia. Prof. Brodjonegoro, who also serves as the commissioner of Telkom, Bukalapak, Indofood and Astra International. During the session, he discussed the evolving landscape of collaboration among regulators, state-owned enterprises, and the private sector. The focus was on delivering innovative solutions to address sustainability challenges in Indonesia and create future opportunities. Prof. Brodjonegoro's perspective provided a comprehensive understanding of the collaborative efforts shaping the sustainable development agenda in Indonesia.

On 9 November, SGFIN hosted a workshop on the topic of energy transition at the Marina Bay Sands Expo & Conventional Centre. The workshop was attended by many industry partners and experts in the field. Panellists include Yuki Yasui (GFANZ), Lim Bey An (MAS), Devin Chan (Infrastructure Asia) and Anil Changaroth (RHT Law). The half-day workshop was filled with deep knowledge sharing, intriguing discussion, and pleasant networking opportunities. We are grateful for all of those who attended and contributed to the lively session!

As part of SGFIN’s objective to foster awareness, we also participated in OCBC Sustainability Day in August 2023 as well as Bank of Singapore Sustainability Day in September 2023. Through the event, we discussed with OCBC Group CEO Helen Wong and BoS CEO Jason Moo about our ongoing research partnership with BOS and OCBC as well as the broad offering of education programmes available.

Thought Leadership

SGFIN @ External Events

SGFIN’s commitment to thought leadership extends beyond the confines of our institution, as evidenced by our active participation in external events. Embracing a proactive approach, we engage with diverse forums, conferences, and industry gatherings, contributing valuable insights and perspectives on sustainable and green finance. We aim to foster meaningful dialogues, inspire collaborative efforts, and shape the trajectory of sustainable financial practices on a broader scale. This external outreach reflects our dedication to driving positive change and influencing the discourse surrounding sustainable finance on a global stage

In 2023, our leaders actively contributed to sustainability dialogues and panel sessions, engaging in discussions on a diverse array of topics. Among the notable events were the Asian Downstream Summit, Asia Clean Energy Summit, GRESB Regional Insights, Singapore Fintech Festival 2023, and the Mandiri Sustainability Forum in Jakarta.

We eagerly anticipate the opportunity to contribute even more insights in 2024, furthering our commitment to fostering meaningful discussions and advancements in the realm of sustainability and green finance.

SGFIN @ Media

Throughout 2023, SGFIN has consistently strengthened its presence in the media landscape by offering insightful commentary. Our leaders have actively provided expert perspectives on sustainable and green finance, contributing to a nuanced understanding of crucial issues. Some of the topics covered include the charging of the use of plastic bags, the import of low-carbon electricity from Indonesia, the approaching capacity limit of Singapore's only landfill, and the implementation of carbon offset measures for air travel passengers.

In the coming year, SGFIN will remain steadfast in its commitment to expanding its role as a source of valuable insights and perspectives. As global conversations around sustainable practices and green finance intensify, SGFIN looks forward to maintaining its active presence in the media landscape, contributing to the ongoing dialogue on sustainable finance and environmental responsibility.

SGFIN in 2024

SGFIN expresses gratitude to all partners for a fantastic 2023 and eagerly anticipates the upcoming year, 2024. To kick things off, please anticipate the following planned events:

SGFIN Sustainability Summit 2024 – 21 March 2024

SGFIN Research Conference on Sustainability 2024 – 22 March 2024

SGFIN-Fidelity Case Competition 2024 – 30 April 2024

Executive Courses

-

- Sustainable Project Financing – 26 to 27 Feb 2024

- Sustainability Reporting and Governance – 29 Feb to 1 March 2024

- Green Finance for the Built Environment – 26 April 2024

- Social and Sustainable Investing – 13 to 14 May 2024

- Financial Valuation of Social and Environmental Impact – 30 to 31 May 2024

- Carbon Accounting for Enterprise – 27 to 28 June 2024